Own your own home

A decent and affordable home is the foundation to build your future.

Please see link below for house availability

Habitat builds and/or rehabilitates homes that are then sold to first-time homebuyers for no more than 30% of their total household income.

Qualifications for Homebuyer Program

1) Ability to Pay

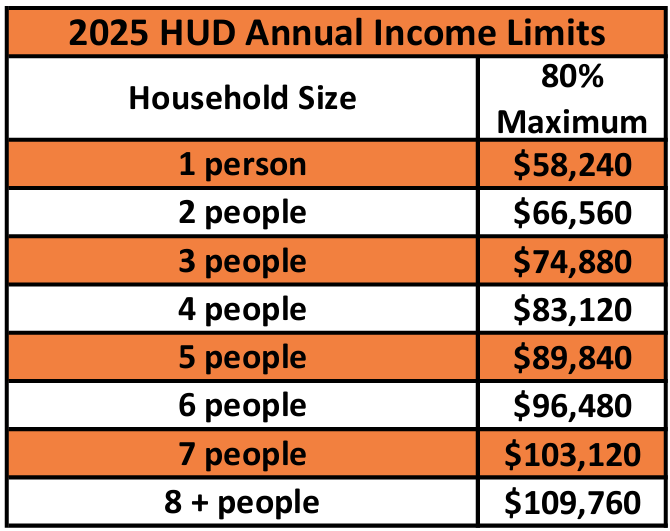

Habitat homebuyers must have a steady source of income that is within income requirements for your household size. You must also maintain good credit. We run an initial credit report for qualification and also monitor credit quarterly while you work towards homeownership.

2) Demonstration of Need

If your housing situation includes one or more of the following examples, you may be eligible to purchase a Habitat for Humanity home.

- Substandard: Examples may include broken plumbing, faulty or unsafe electrical service, poor heating, deteriorating structure, or any other health and safety issue.

- Cost burdened: Rental payments are 35% or more of your total income.

- Overcrowded: If an adult and child, more than two children, or two children of the opposite sex share a bedroom.

3) Willingness to Partner

Willingness to partner is your household’s commitment to provide consistent, dedicated work to the Greater Rochester Habitat for Humanity program. Examples include:

- Single applicants must complete a minimum of 200 sweat equity hours, 100 of which must be performed on a Habitat construction site.

- Dual applicants must complete a minimum of 300 sweat equity hours, 150 of which must be performed on a Habitat construction site.

- Homebuyers must attend financial literacy and other required educational classes.

- Homebuyers must meet with your volunteer coach at least once

per month.

- Homebuyers must provide proof of income and savings once a month.

- Homebuyers are required to provide $3,000 towards the closing costs of the home and will be expected to achieve this goal while completing program requirements.

- Homebuyers must make on time monthly home mortgage payments.

- Homebuyers must maintain and repair the home after occupancy.

***Homebuyers must acknowledge the implications of a highly publicized program. Homeowner should be prepared to share their story through in-person communications, area media (e.g., newspaper, radio, internet) and GRHFH publications (e.g., photos, videos, audio recordings) if requested. Note: not all projects will be publicized, and in extenuating circumstances when safety and privacy are a primary concern, GRHFH will work with the Partner(s) to determine what is appropriate to be made public.

Determining your Household income: First identify your household size. This is the total number of people who would be living in the Habitat home should you be accepted to the program. Then, identify the total GROSS income for the entire household. This is any earned wages before tax deduction, all SSI or SSD, and any income from self-employment, child support, pension, or survivor benefits for everyone that is part of the household. Once you have that number, find your household size on the chart below, and identify your income bracket.

See our current homeownership opportunities

Homebuyer Resources

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

Homebuyer Handboook

The Habitat home buying program is complex and we understand there is a lot to keep track of. To help with that, we have developed a handbook that our partner families can reference at any time.

Sweat Equity Logs

Habitat homebuyers are responsible for keeping track of their community service hours. To help with that, we provide sweat equity logs that can be downloaded and printed for convenience.

Homebuyer Sweat Equity Sign-Up

Habitat homebuyers are required to complete 50% of their total sweat equity commitment on one of our construction sites or at one of our ReStores. To sign up for sweat equity shifts, sign in here.

Monthly Reporting

Once a month, Habitat homebuyers are required to submit updated documents to the Family Services team. All documents must be submitted electronically though our online form.